Enjoy a reloadable and secure card with the same convenience as a standard credit card.

BMO Prepaid Mastercard®*

Enjoy extended warranty and purchase protection.37

Make purchases anywhere Mastercard is accepted while receiving protection against unauthorized use — making it safer than carrying cash.

Use your prepaid credit card at any of the 30 million locations Mastercard is accepted, and get cash at over a million ATMs.23

Save up to 20% on National Car Rental®†† and Alamo Rent A Car®†† and up to 5% on Enterprise Rent-A-Car®†† at locations worldwide using the Car Rental Booking tool.25

Ready to apply?

It’s simple – load it and go.

We’ll respond in under 60 seconds.

Digital features and security at your fingertips

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Safety and security

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Financial insights

Stay on top of your spending with a personalized look at your money.

Credit score

Get free, 24/7 access to CreditView with no impact to your credit score.

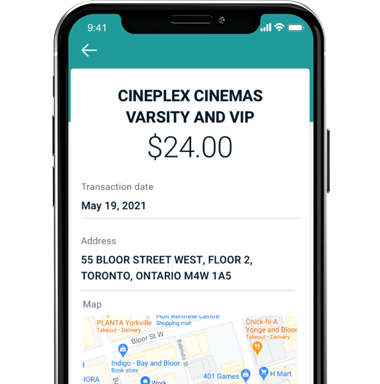

Detailed transaction view

Get a detailed view of when and where you made your purchases on the BMO mobile app.

FAQs

A prepaid card works just like a standard credit card except you have to load funds on it before you can make a purchase. Once your card runs out of money, you’ll have to load more funds on it before you can use it again. And since you load the card with your own money, there’s no balance that you owe and have to pay back.